Likely when you think of the words ‘deep tech’ – you picture futuristic technologies being built by scientists in labs. And you’d be mostly right! Deep technology is defined by most as technologies based on ‘tangible engineering innovations or scientific discoveries’. Except that deep tech isn’t really meant to be ‘science for the sake of science’, like a lot of the fundamental (but also amazing) research that you find in labs. Instead, deep tech is meant to be focused on practical, STEM-driven solutions to some of the biggest issues we are facing as a society. I mentioned some of the applications of deep tech recently in another post – but these can include tackling cancer treatment and diagnosis, facing up to climate change, feeding the world’s population and yes, even managing a global pandemic.

So what is included under the deep tech umbrella? According to the Boston Consulting Group, who’ve written a great deal about the field, here are some key areas of focus:

- Biotechnology

- Nanotechnology

- Drones

- Robotics

- Advanced materials

- Blockchain

- Quantum computing

- Artificial Intelligence

- Photonics and electronics

I’m sure most people have heard of at least a few of these buzzwords before! Looking a bit further, the common pattern that emerges from glancing over this list is that many of these different technologies are new, cutting edge and often protected by patents. They are built and driven by those with deep scientific or engineering backgrounds and they are likely to emerge from large, well-established institutions like research centres, hospitals or universities. As was touched on above, they are also mostly problem-oriented (i.e. aiming to solve society’s greatest challenges). And since investment is always a focus here, you can certainly appreciate that it takes a great deal of it to get some of these technologies off the ground! In other words, they can be tremendously capital intensive and require millions of dollars before they’re brought to the market.

Another interesting fact – unlike most software-focused ventures, as much as 83% of deep tech innovations are built around a physical product. So this begs the question – are Facebook, Google, Uber or Amazon deep tech? Well in this day and age – not really. These Internet app-based megastars are actually just mainstream (ok fine – boring) tech. The line is – of course- a bit blurry – but they aren’t exactly built on a new scientific discovery which has taken years and lots of capital to develop. But that doesn’t mean they don’t include (or intend to include) deep tech. In fact, back in 2018, Facebook opened a new lab in London to support start-ups solely focused on deep technology. This kind of move made sense for a tech company focused on investing in artificial intelligence, deep learning and even augmented and virtual reality – all deep tech. Indeed, deep tech itself has actually long been identified as a category for investment, as a sort of subsection of the tech industry. And investment into deep tech has been increasing. In fact, according to a report released by the Boston Consulting Group, disclosed investment into deep tech has grown to more than $60 billion in 2020 (it was apparently $15 billion in 2016). The report mentions a few other figures which paint a picture of the deep tech investment landscape over the same time period:

- Private investor transactions into deep tech have rose from $13 million to $44 million

- Investments from corporations into deep tech have rose from $5 billion to $18 billion

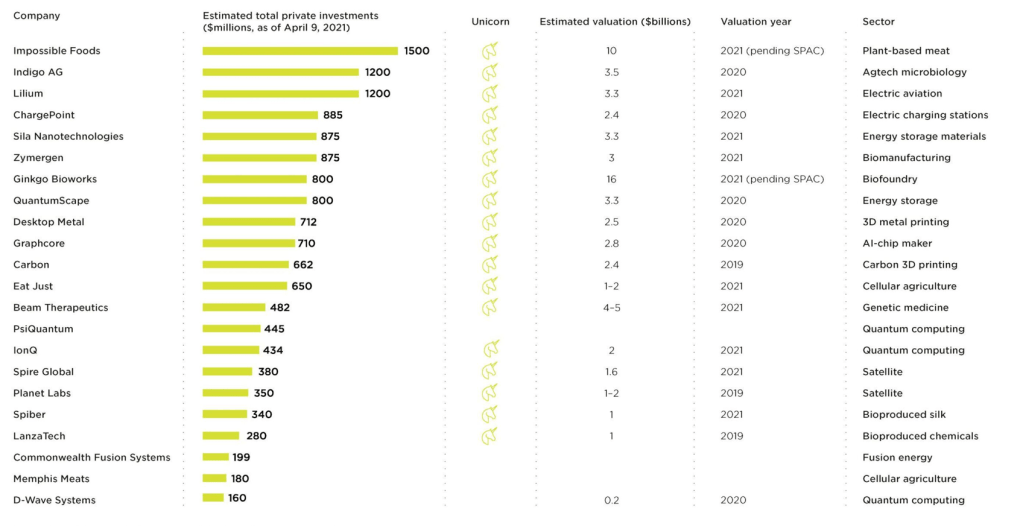

Now, increased investment into a certain field isn’t really anything to brag about. In fact – from the point of view of the investor – it can be quite a bit better to go where no one else is going, since it means that the company isn’t overhyped and therefore possibly overpriced. Plenty of deep tech initiatives are unfortunately very likely to be both of these things! But what this increased investment does indicate is an increased ‘trust’ from investors in newer and risker areas such as the ones mentioned above. And that’s good news for a field that requires so much capital to get going. I mean, just look at the estimated total private investments listed in the chart below, for some of deep tech’s ‘success stories’:

Alongside the high capital requirements needed at the beginning of a deep tech venture, investors also have to be comfortable with the fact that it can take years before the technology is ready to hit the market and start generating returns. In fact, 7-10 years is quite a common timeframe for investors to face before they start reaping the rewards of their investment. This fact alone would make many investors queasy! So who on earth are these (supposedly very patient) investors and what drives them? This remains a key interest of mine and I’ve actually conducted interviews both with deep tech investors and with deep tech start-ups on the process of seeking and receiving investment. I can cover my findings from my interviews in another post in detail. I am also really interested in researching the entire deep tech commercialization pathway from lab to market – so I can create another dedicated post on that as well! But for now, key investment into deep tech tends to come from:

- Angel Investors – high-net-worth individuals who provide financial backing for early-stage start-ups

- Venture Capital (VC) – a form of private equity financing provided by a firm to early-stage, and emerging companies with high growth potential

- Public Funding – through government, academic or research grants

Deep tech-focused angel investors tend to be highly-experienced business leaders and very passionate about their field(s) of choice. They may have backgrounds in science and/or engineering and perhaps have become recently retired and now have money to spend. Key fact here – this money is their own. More often than not, they want to become deeply involved in the company they’re investing in – either as mentors to the founding team or as partners in the business. Although returns are important to them, many angels understand that start-up investment is a complete gamble – they are investing more to seek fulfillment and to help accelerate a field/team/technology/cause that they believe in.

On the other hand, VCs tend to be more returns-focused. Because they are investing money on behalf of an external investor (i.e. a university, high net-worth family or even a corporation) as a firm, they are more often obligated to find and invest in businesses with a demonstrated growth potential. Growth tends to be a key word in VC. Trouble is, the kind of growth that most VCs seek just doesn’t apply to early stage deep tech. For example – not many new immunotherapy-focused companies are measuring their customer churn rates! They’re just trying to get the technology developed and out there in the first place. Luckily, there’s a growing number of deep tech focused VC firms which are able to provide more targeted help. Here are a few:

Ahren Innovation Capital

LongWall Ventures

Earlybird Venture Capital

Deep Tech Ventures

Angular Ventures

Propagator VC

As deep tech-focused VCs, these guys can be expected to be more familiar with advanced science (at least you’d hope!) and should accordingly expect to carry greater fund sizes with longer lifetimes and have access to the appropriate experts to vet deals.

Finally, despite increased private backing from angels and VCs, public or grant funding of deep tech is still very common and is likely the first type of funding that a scientist-turned-entrepreneur might reach out for when they begin the commercialization process. This is particularly true of PhD students who are looking to turn their research into a company. Due to their time spent in academia, they are likely to be most familiar with the grant schemes so often associated with their universities. Alongside angels, VC’s and public funding, other types of investment into deep tech might include donations-based funding or even crowdfunding. Propel(x) jumps to mind as a deep-tech focused crowdfunding platform targeted towards angel investors (with a female founder).

Hopefully this article has helped to provide a bit of insight into the world of deep tech and provided some context for future blog posts! If you want to read more about it, deep tech is often included in the Science, Tech or Health sections of many news sources.